NETELLER Review – Overview

Our detailed NETELLER review will show you the benefits and guides you through the registration and verification process. You will also learn more details about security, their VIP System much more.

Set up your new account fast and easy and enjoy a lot of benefits by reaching higher VIP levels like increased transfer limits, lower fees, a free NETELLER MasterCard, unique monthly benefits, and much more.

Please contact us if you have any questions.

Pros & Cons

![]() Overall good conditions for VIPs.

Overall good conditions for VIPs.

![]() Accepted at poker-, sportsbetting- & Forex-sites.

Accepted at poker-, sportsbetting- & Forex-sites.

![]() NETELLER VIP Program.

NETELLER VIP Program.

![]() MasterCard only for SEPA Countries.

MasterCard only for SEPA Countries.

![]() Currency exchange fees.

Currency exchange fees.

NETELLER Review – Facts & History

NETELLER currently is one of the biggest names on the eWallet market. Launched in 1999 and offering their services only in a few countries, customers from over 200 countries can now use it to transfer money to different merchants and enjoy a high availability especially in the sports betting sector, but also in any other gambling related area.

It was founded in 1996 and is owned and operated by Optimal Payments PLC, now Paysafe Group. Optimal Payments PLC has been publicly traded on the London Stock Exchange since its initial public offering in 2004, and its stocks rose over the last years consistently. They are regulated by the Financial Conduct Authority in the United Kingdom and are authorized electronic money issuers.

As of 2015, Optimal Payments as the mother company of NETELLER bought Skrill, so it is now effectively one company. Now it is also possible to fund your account via Skrill and vice versa using the Money-In or Upload Section of the respective accounts.

NETELLER Review – Screenshots

NETELLER Review – Registration

The NETELLER registration process is fast and easy. Just Use the following instructions to set up a fully functional NETELLER account with a Bronze Pro VIP Upgrade.

Three steps to register your NETELLER account

- Sign-up for your new account through the NETELLER homepage.

- Enter your details like name, residential address, email address, password on the registration form.

- Finish the verification process by uploading your documents.

NETELLER Review – Verifications

The verification process requires several steps, but once the required documents are sent in, the verification will be approved within 1 business day.

Check our NETELLER verification guide to find all details and information about the process.

Fees

Using a NETELLER account also comes with different kind of fees.

Covering them all in this review would be too much, which is the reason we decided to create a NETELLER Fee Overview, where we go into this topic thoroughly and in more detail.

Let us have a brief look here at some of the essential fees so that you already have something you can work with:

- Deposit fee:

The cost to deposit to your NETELLER account is 2.5% for all deposit options.

Even a higher VIP level does not lower this fee. - Bank Withdrawal fee:

The fee for withdrawing to your bank account is 10 USD.

Once you reach at least the Gold VIP status, it will become free (check our NETELLER VIP Page to find all details for free and more accessible upgrades). - Money transfer fee:

The account fee is 20%, with a 30 USD minimum for the first transfer.

Starting with the 2nd transfer, it will be lowered to 1.45% and a maximum of 10 USD for our clients.

A free money transfer is, depending on your country of residence, possible with Silver or Gold VIP.

Of course there are many more potential fees, but this will give you a good overview about the most important ones already.

Limits

Similar to the fees, limits are a major topic as well.

However, there is good news for all VIP clients: Once you reach a certain VIP level, all limits will be removed from your account.

Well, let’s say at least the most important one, the money transfer limit.

All daily, weekly, and monthly limits are removed, and you will have a transaction limit of 50,000 USD.

So you can do as many transfers as you want, which is excellent compared to regular non-VIP NETELLER customers, who have much lower limits.

All other limits will be increased as well, but besides your VIP level, the country of residence is also a factor that has to be considered.

To cover this in more detail, we gathered all information and created the NETELLER Limit Overview page for you where you can find all details about all kinds of limits.

Most likely, you will also find some local payment options in your account.

All limits for your account you can also find from within your NETELLER account on your deposit or withdrawal page.

Please note, not all limits can be increased as sometimes the payment provider adds a limitation to that, but the limits for the most common options should be high enough for most customers.

Security

The Paysafe brand offers an in-house security feature which will make sure to keep your funds safe at any time. The so called two-step authentication works as a two-factor authentication and puts youraccount at an even higher security level. It combines something you know (password) with something you have (authentication code).

The authentication code changes every 30 seconds and makes it almost impossible for someone to break into your account. In combination with a secure password, you will have a great place to keep your funds safe. Please also check our two-step authentication page to find a full guide about how to set up this feature and how to use it.

VIP Program

For the most loyal customers there is an NETELLER VIP Program with additional rewards, higher limits and lower fees.

The VIP Program and status are calculated upon the quarterly transaction activity of the account, and by climbing through their VIP levels, you can enjoy several benefits.

VIP Fraud Guarantee, Multiple Currency Accounts, a dedicated VIP manager, limit increases, higher cash ATM withdrawal limits, lower fees, and some exceptional benefits for the highest two limits.

The following VIP level is available:

| NETELLER Silver VIP | Transfer 15,000 USD to merchants per calendar quarter. |

| NETELLER Gold VIP | Transfer 45,000 USD to merchants per calendar quarter. |

| NETELLER Diamond VIP | Transfer 150,000 USD to merchants per calendar quarter. |

| NETELLER Exclusive VIP | Transfer 600,000 USD to merchants per calendar quarter. |

See a full list of benefits on our NETELLER VIP Progam page.

NETELLER Review – MasterCard

The Net+ PrePaid MasterCard is a plastic card that is sent to you that you can use for cash withdrawals at thousands of supported MasterCard ATMs worldwide or pay in any shop that accepts MasterCards. With the Net+ Prepaid MasterCard the available balance of your card is the same as the balance of your eWallet account and cannot be exceeded.

Since the end of September 2016, NETELLER does not offer MasterCards for residents of NON-SEPA countries any longer. We have summarized all details for you. Besides the fact that those clients are not able to receive a new Card, all other services will stay available.

Check our NETELLER MasterCard page for more details about their limits and fees and also about the Virtual Card.

NETELLER Review – Mobile App

More and more people are following the mobile trend and therefore, an easy-to-handle app is an important factor for every company. The NETELLER app allows you to manage your digital wallet account and send and receive your funds to anyone, anywhere, at any time. You can also use your app to fully verify your account and send all taken pictures directly through your app to NETELLER.

Deposit Options

NETELLER offers a lot of deposit and withdrawal options. The following payment options are available to deposit:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Please note, depending on your country of residence the fees for the different options can vary.

Withdrawal Options

NETELLER offers a lot of different payment options to cashout. The following options are available to withdraw money from your account:

![]()

![]()

![]()

![]()

You can also use your NETELLER NET+ MasterCard to withdraw your money at an ATM or use the money transfer option to send your funds to another account (p2p).

Support and Live Chat

Same as the Skrill Support it is not really great as it should be. This is also clear from the very low 1.4/10 Trustpilot Rating.

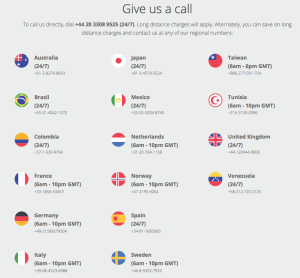

They do offer Live Chat, Telephone, and Email Support, but the Support is often slow or not helpful at all.

Just contact us if you need help! We are happy to help.

Serviced and restricted countries

We want to provide some more information about serviced and restricted countries. Using an eWallet for your payments is the future of online payment. It is a fast, easy and secure way of doing payments.

However, you are only allowed to use the services if it is legal to do so in your country of residence. Here is a full and detailed overview of all the restrictions.

To find out if your country is supported, please check the NETELLER homepage.