Skrill Review – Overview

In our detailed Skrill review we show you how easily it is to set up and verify your new account in 2020.

Additionally, we also give you more details about the benefits that come with such an eWallet account like their VIP System, the MasterCard, and much more.

You will also learn how we can help you to optimize your account and which great benefits you enjoy by signing up with us.

Pros & Cons

![]() Capped p2p fees.

Capped p2p fees.

![]() Accepted at poker-, sportsbetting- & Forex-sites.

Accepted at poker-, sportsbetting- & Forex-sites.

![]() Fast & easy Support for VIPs.

Fast & easy Support for VIPs.

![]() MasterCard only for SEPA Countries.

MasterCard only for SEPA Countries.

Skrill Review – Facts & History

Skrill is one of the oldest eWallet operators on the market. With 15 years (founded 2001), it is one of the most recognized names on the eWallet market. They were founded under the name “Moneybookers”, took over Paysafecard in February 2013, and were re-branded in March 2013. In August, corporate venture capital (CVC) announced the acquisition of Skrill for 800 million USD. The eWallet Provider now belongs to the Paysafe Group PLC. It is regulated by the Financial Conduct Authority in the UK and is allowed to issue electronic money and payment instruments.

The last half of 2012 we saw NETELLER achieve a 21% increase in new member sign-ups. The Paysafe company was able to double their memberships to more than 35 million as well as their overall transfers to 55 billion EUR within the last 2 years.

Skrill is widely accepted at most poker sites, sportsbooks, casino operators and forex providers. It is safe to say that there is no way around the former Moneybookers to be able to move your money around fast and easy between different merchants.

Skrill Review – Screenshots

Registration

Register your new account will only take a few minutes and by using the following steps you will create an account easy and fast.

3 steps to register your new account

- Sign-up through the Skrill homepage.

- Enter your details like name, residential address, email address, password on the registration form.

After these steps your account is almost ready. The last step is the verification process, which is necessary to remove all restrictions.

Verification

Only a fully verified account can enjoy all of the services without any restrictions.

Documents to verify your account

You can upload your verification documents directly in your account. To fully verify your account you need to send

- the front and back side of your ID card or passport.

- a selfie of your face made with through a webcam or your mobile app.

- a recent utility bill (gas, electricity or any other household bill) or a bank statement, showing your full name and address and not older than 90 days.

Please make sure to send clear and legible copies of your documents to ensure a fast verification for your account.

For more details about the verification process just check our Skrill Verification page or contact us for any question

Skrill Review – Fees

There are different fees which can apply depending on how you use your Skrill account.

Therefore, it is important to make sure what exactly are the fees are for your case and of course if there is a way to avoid or at least lower the fee.

The easiest way to lower your fees or remove them is by reaching a higher VIP level.

Since the fees are quite a big topic, you should check out our detailed Skrill Fees 2020 page for all details and information about deposit and withdrawals, currency conversion, MasterCard Fees, withdrawal, Crypto Fees, and much more.

Skrill Review – Limits

Money transfer between your eWallet accounts will, therefore, be no problem anymore and not limits to any specific amount.

At least as long as your account is fully verified, but more details about this you can find on our verification section.

The deposit limits will also be increased, but not for all deposit options.

Depending on your country of residence and your VIP status you will have different options and also the limits can vary.

In our detailed Skrill Limit review we have gathered all information for you to give you a quick and easy overview about how to increase your limits.

Security

Security is an important topic in general, but especially for eWallet customers it is even more important to keep your funds as safe as possible. The eWallet provider offers a great in-house security feature, which helps you to secure your account.

Two-Step Authentication (2FA)

Every time you sign into your account or make a transaction your smartphone or tablet will generate a one-time-use code. This code comes in addition to standard login details and changes every 30 seconds. This makes it almost impossible for someone to break into your account. In combination with strong password you have a really safe place to keep your fuds.

You can find a quick step-by-step guide about how to set up this additional security feature on our Security page.

There was also a hardware security token available some years ago to protect your account. This token is no longer available and was replaced by the two-step authentication. However, customers who still have an old token can use it.

There is also a lot of Skrill phishing on the web, so make sure to check our security article about this topic. You will find some more details about how to detect those sites and some general information about your security.

VIP Program

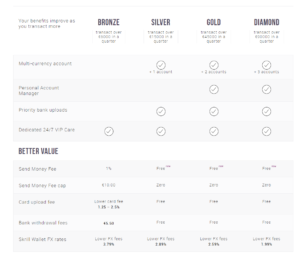

Skrill offers a really simple and straightforward VIP system. With this reward system, you can get rid of most of your fees or at least lower them drastically.

|

Transfer 6,000 EUR to merchants per quarter to reach bronze VIP Status. |

|

Transfer 15,000 EUR to merchants per quarter. |

|

Transfer 45,000 EUR to merchants per quarter. |

|

Transfer 90,000 EUR to merchants per quarter. |

To see a full list of benefits, please check our VIP Progam page.

Skrill Review – MasterCard

The Skrill Card works like every other prepaid MasterCard and is the perfect way to get access to your funds fast and easy all over the world. You can access your savings without worrying about spending too much money. Your available balance with the prepaid MasterCard is the same as in your digital wallet.

Compared to other eWallet providers the fees for the MasterCard are very low and Silver VIPs or higher can use the card for free without paying any fees.

Skrill Review – Mobile App

The extreme popularity that mobile devices like smartphones and tablets enjoy is really impressive and therefore it is important for a company to offer an easy to handle and comfortable mobile app.

The app allows customers to manage your eWallet account and send and receive instant payments to anyone, anywhere and at any time. You can also check your account balance or upload your verification documents through the app directly.

Overall user experience with the mobile app is really good. It is available for free on Android and iOS platforms and can be found in Apple app store or Google Play store.

For a detailed breakdown of all the information we have also added a review page that you will find at the link below.

Skrill Review – Deposit Options

There are a lot of different options available to deposit funds into your account .Besides the standard bank transfer option, you can also use:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Please note, depending on your country of residence the fees for the different options can vary. Make sure to check the fees for your current location before making a deposit.

Skrill Review – Withdrawal Options

The following payment options are available to cashout. You can withdraw your money by using the following options:

![]()

![]()

![]()

In addition you can also use your PrePaid MasterCard for ATM withdrawals and send money via p2p transfer to another account.

Support

If you have done some research or used the eWallet yourself, you might have noticed their Support is not particularly good. They have only a 1.5 score out of 10 on Trustpilot.

Please do not hesitate to contact us if you have any issues or problems with Skrill. We are there to help!

Skrill Review – Serviced and restricted countries

Skrill offers payment processing services in almost all countries with just a few exceptions. Please make sure to check with Skrill to find out if your country is supported or if there are any restrictions for you specific country.